Depreciation Rate On Medical Equipment As Per Companies Act . 129 rows table of contents. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. Depreciation calculator for companies act 2013. Depreciation as per companies act. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. In this article we have compiled depreciation rates under. 127 rows sponsored.

from www.vrogue.co

Depreciation as per companies act. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 127 rows sponsored. 129 rows table of contents. In this article we have compiled depreciation rates under. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. Depreciation calculator for companies act 2013.

Depreciation Rate As Per Companies Act How To Use Dep vrogue.co

Depreciation Rate On Medical Equipment As Per Companies Act Depreciation calculator for companies act 2013. In this article we have compiled depreciation rates under. Depreciation calculator for companies act 2013. Depreciation as per companies act. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. 127 rows sponsored. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. 129 rows table of contents.

From www.slideteam.net

Calculation Of Depreciation On Fixed Assets Depreciation Expense Ppt Depreciation Rate On Medical Equipment As Per Companies Act Depreciation calculator for companies act 2013. In this article we have compiled depreciation rates under. Depreciation as per companies act. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part. Depreciation Rate On Medical Equipment As Per Companies Act.

From dxozkukvg.blob.core.windows.net

Medical Equipment Depreciation Rate Sars at Margaret Oliver blog Depreciation Rate On Medical Equipment As Per Companies Act 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. 129 rows table of contents. 127 rows sponsored. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. companies act 2013 does not provide the rates of the depreciation,. Depreciation Rate On Medical Equipment As Per Companies Act.

From dxozkukvg.blob.core.windows.net

Medical Equipment Depreciation Rate Sars at Margaret Oliver blog Depreciation Rate On Medical Equipment As Per Companies Act 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. In this article we have compiled depreciation rates under. 127 rows sponsored. 129 rows table of contents. Depreciation as per. Depreciation Rate On Medical Equipment As Per Companies Act.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation Rate On Medical Equipment As Per Companies Act In this article we have compiled depreciation rates under. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. 103 rows as per schedule ii of companies act, 2013. Depreciation Rate On Medical Equipment As Per Companies Act.

From www.vrogue.co

Depreciation Rate As Per Companies Act How To Use Dep vrogue.co Depreciation Rate On Medical Equipment As Per Companies Act 127 rows sponsored. Depreciation as per companies act. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. companies act 2013 does not provide. Depreciation Rate On Medical Equipment As Per Companies Act.

From www.vrogue.co

Depreciation Rate As Per Companies Act How To Use Dep vrogue.co Depreciation Rate On Medical Equipment As Per Companies Act Depreciation as per companies act. 129 rows table of contents. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. Depreciation calculator for companies act 2013. 127 rows sponsored. In this article we have compiled depreciation rates under. other than depreciation rates, the basic. Depreciation Rate On Medical Equipment As Per Companies Act.

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Depreciation Rate On Medical Equipment As Per Companies Act Depreciation as per companies act. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. In this article we have compiled depreciation rates under. 127 rows sponsored. Depreciation calculator for companies act 2013. other than depreciation rates, the basic differences depreciation calculation as per the. Depreciation Rate On Medical Equipment As Per Companies Act.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation Rate On Medical Equipment As Per Companies Act In this article we have compiled depreciation rates under. 127 rows sponsored. Depreciation as per companies act. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part. Depreciation Rate On Medical Equipment As Per Companies Act.

From www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider Depreciation Rate On Medical Equipment As Per Companies Act companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. 127 rows sponsored. 129 rows table of contents. Depreciation calculator. Depreciation Rate On Medical Equipment As Per Companies Act.

From www.bmtqs.com.au

Depreciation On Medical Equipment BMT Insider Depreciation Rate On Medical Equipment As Per Companies Act 129 rows table of contents. 127 rows sponsored. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. Depreciation calculator for companies act 2013. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. except. Depreciation Rate On Medical Equipment As Per Companies Act.

From studylib.net

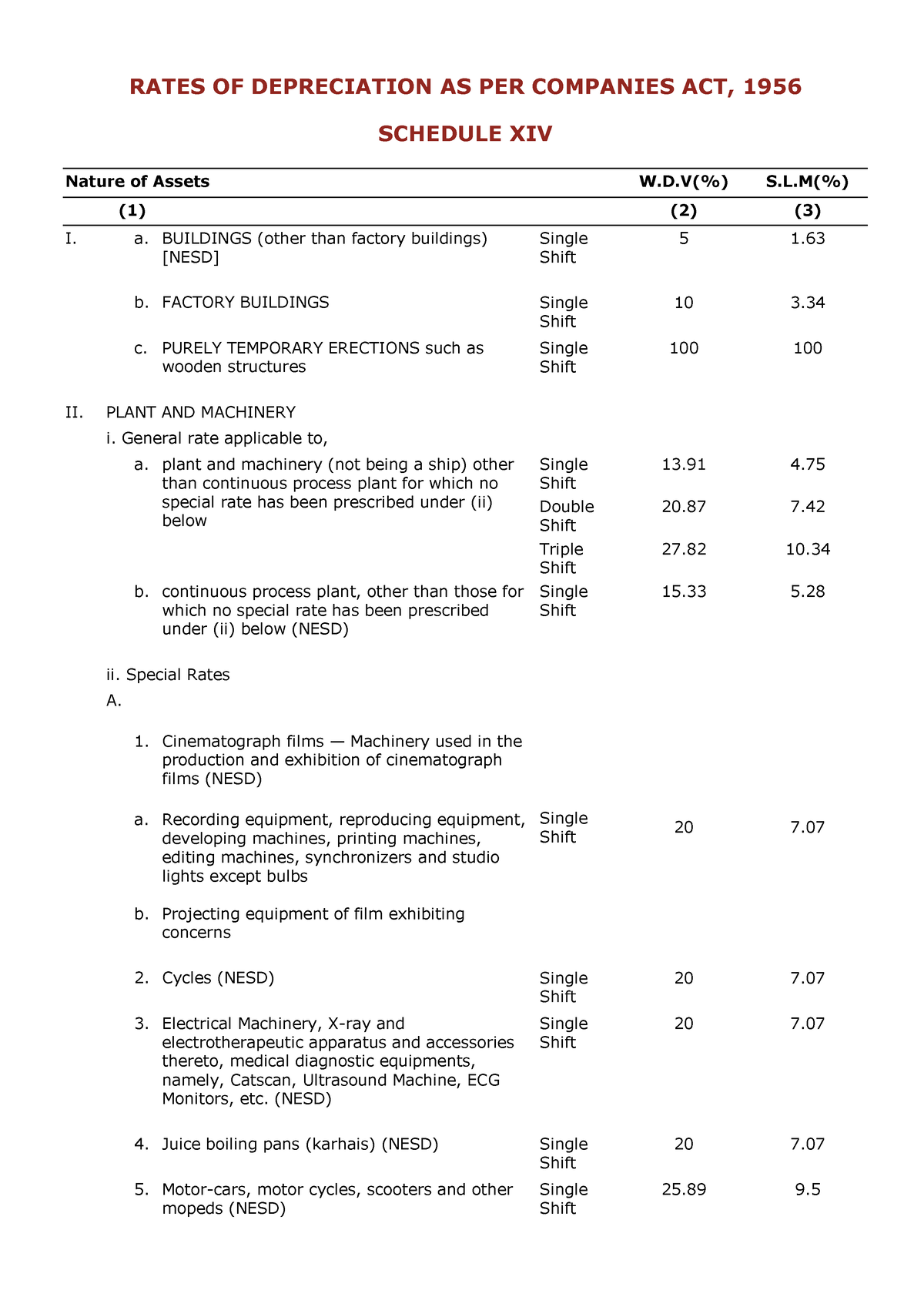

rates of depreciation as per companies act Depreciation Rate On Medical Equipment As Per Companies Act In this article we have compiled depreciation rates under. Depreciation calculator for companies act 2013. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 129 rows table of contents. 127 rows sponsored. other than depreciation rates, the basic differences depreciation calculation. Depreciation Rate On Medical Equipment As Per Companies Act.

From ratinglog.blogspot.com

Depreciation Rate Chart For Ay 2018 19 Rating Log Depreciation Rate On Medical Equipment As Per Companies Act Depreciation calculator for companies act 2013. 127 rows sponsored. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. In this article we have compiled depreciation rates under. . Depreciation Rate On Medical Equipment As Per Companies Act.

From www.teachoo.com

Depreciation Chart as per SLM Method Depreciation Chart Depreciation Rate On Medical Equipment As Per Companies Act 129 rows table of contents. Depreciation calculator for companies act 2013. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 127 rows sponsored. Depreciation as per companies act. 103 rows as per schedule ii of companies act, 2013 the description of. Depreciation Rate On Medical Equipment As Per Companies Act.

From www.scribd.com

Depreciation Rate Chart (As Per Part "C" of Schedule II of The Depreciation Rate On Medical Equipment As Per Companies Act Depreciation as per companies act. In this article we have compiled depreciation rates under. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. Depreciation calculator for companies act 2013. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule. Depreciation Rate On Medical Equipment As Per Companies Act.

From gstguntur.com

Depreciation Rate Chart as per Companies Act 2013 with Related Law Depreciation Rate On Medical Equipment As Per Companies Act In this article we have compiled depreciation rates under. Depreciation calculator for companies act 2013. 129 rows table of contents. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. . Depreciation Rate On Medical Equipment As Per Companies Act.

From exoabhvbs.blob.core.windows.net

Depreciation Rate On Office Equipment As Per It Act at Louis Alvarez blog Depreciation Rate On Medical Equipment As Per Companies Act 127 rows sponsored. other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. In this article we have compiled depreciation rates under. 129 rows table of contents. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. Depreciation. Depreciation Rate On Medical Equipment As Per Companies Act.

From www.vrogue.co

Depreciation As Per Schedule Ii Of Companies Act 2013 vrogue.co Depreciation Rate On Medical Equipment As Per Companies Act companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. In this article we have compiled depreciation rates under. Depreciation calculator for companies act 2013. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c. Depreciation Rate On Medical Equipment As Per Companies Act.

From exoobfrcl.blob.core.windows.net

Depreciation For Office Equipment As Per Companies Act at Depreciation Rate On Medical Equipment As Per Companies Act other than depreciation rates, the basic differences depreciation calculation as per the income tax act and. Depreciation as per companies act. except for assets in respect of which no extra shift depreciation is permitted (indicated by nesd in part c above), if an. companies act 2013 does not provide the rates of the depreciation, instead it provides,. Depreciation Rate On Medical Equipment As Per Companies Act.